Good Morning Avid Readers,

Hope u had a chilled night… well my night was short (it always is).. Just finished my workout sessions ( workout tips coming out soon… keep u guys posted on that one) and i decided to give you guys something new. Today i decided to drop two new posts because i haven’t dropped any for a week and running. So the topics for today are Accounting Basics and 19th Century inventions. The Basics of accounting will be splitted into two ( we don’t want our readers to be reading without following….. savvy).

So lets get started!

Accounting can be divided into several areas of activity. These can certainly overlap and they are often closely intertwined. But it’s still useful to distinguish them, not least because accounting professionals tend to organize themselves around these various specialties.

Financial Accounting

Financial accounting is the periodic reporting of a company’s financial position and the results of operations to external parties through financial statements, which ordinarily include the balance sheet (statement of financial condition), income statement (the profit and loss statement, or P&L), and statement of cash flows. A statement of changes in owners’ equity is also often prepared. Financial statements are relied upon by suppliers of capital – e.g., shareholders, bondholders and banks – as well as customers, suppliers, government agencies and policymakers.

There’s little use in issuing financial statements if each company makes up its own rules about what and how to report. When preparing statements, Nigerian companies use Generally Accepted Accounting Principles, or GAAP. The primary source of GAAP is the rules published by the FASB and its predecessors; but GAAP also derives from the work done by the SEC and the AICPA, as well standard industry practices.

Management Accounting

Where financial accounting focuses on external users, management accounting emphasizes the preparation and analysis of accounting information within the organization. According to the Institute of Management Accountants, it includes “…designing and evaluating business processes, budgeting and forecasting, implementing and monitoring internal controls, and analyzing, synthesizing and aggregating information…to help drive economic value.”

A primary concern of management accounting is the allocation of costs; indeed, much of what now is considered management accounting used to be called cost accounting. Although a seemingly mundane pursuit, how to measure cost is critical, difficult and controversial. In recent years, management accountants have developed new approaches like activity-based costing (ABC) and target costing, but they continue to debate how best to provide and use cost information for management decision-making.

Auditing

Auditing is the examination and verification of company accounts and the firm’s system of internal control. There is both external and internal auditing. External auditors are independent firms that inspect the accounts of an entity and render an opinion on whether its statements conform to GAAP and present fairly the financial position of the company and the results of operations. In the U.S., four huge firms known as the Big Four – PricewaterhouseCoopers, Deloitte Touche Tomatsu, Ernst & Young, and KPMG – dominate the auditing of large corporations and institutions. The group was traditionally known as the Big Eight, contracted to a Big Five through mergers and was reduced to its present number in 2002 with the meltdown of Arthur Andersen in the wake of the Enron scandals.

The external auditor’s primary obligation is to users of financial statements outside the organization. The internal auditor’s primary responsibility is to company management. According to the Institute of Internal Auditors (IIA), the internal auditor evaluates the risks the organization faces with respect to governance, operations and information systems. Its mandate is to ensure (a) effective and efficient operations; (b) the reliability and integrity of financial and operational information; (c) safeguarding of assets; and (d) compliance with laws, regulations and contracts.

Tax Accounting

Financial accounting is determined by rules that seek to best portray the financial position and results of an entity. Tax accounting, in contrast, is based on laws enacted through a highly political legislative process. In the U.S., tax accounting involves the application ofInternal Revenue Service rules at the Federal level and state and city law for the payment of taxes at the local level. Tax accountants help entities minimize their tax payments. Within the corporation, they will also assist financial accountants with determining the accounting for income taxes for financial reporting purposes.

Fund Accounting

Fund accountingis used for nonprofit entities, including governments and not-for-profit corporations. Rather than seek to make a profit, governments and nonprofits deploy resources to achieve objectives. It is standard practice to distinguish between a general fund and special purpose funds. The general fund is used for day-to-day operations, like paying employees or buying supplies. Special funds are established for specific activities, like building a new wing of a hospital.

Segregating resources this way helps the nonprofit maintain control of its resources and measure its success in achieving its various missions.

The accounting rules for federal agencies are determined by the Federal Accounting Standards Advisory Board, while at the state and local level the Governmental Accounting Standards Board (GASB) has authority.

Forensic Accounting

Finally, forensic accounting is the use of accounting in legal matters, including litigation support, investigation and dispute resolution. There are many kinds of forensic accountingengagements: bankruptcy, matrimonial divorce, falsifications and manipulations of accounts or inventories, and so forth. Forensic accountants give investigate and analyze financial evidence, give expert testimony in court and quantify damages.

The Difference Between Accounting and Bookkeeping

Bookkeeping is an unglamorous but essential part of accounting. It is the recording of all the economic activity of an organization – sales made, bills paid, capital received – as individual transactions and summarizing them periodically (annually, quarterly, even daily). Except in the smallest organizations, these transactions are now recorded electronically; but before computers they were recorded in actual books, thus bookkeeping.

The accountants design the accounting systems the bookkeepers use. They establish the internal controls to protect resources, apply the principles of standards-setting organizations to the accounting records and prepare the financial statements, management reports and tax returns based on that data. The auditors that verify the accounting records and express an opinion on financial statements are also accountants, as are management, tax and forensic accounting specialists.

Double-Entry Bookkeeping

The economic events of a business are recorded as transactions and applied to the accounts (hence accounting). For example, the cash account tracks the amount of cash on hand; the sales account records sales made. The chart of accounts of even small companies has hundreds of accounts; large companies have thousands.

The transactions are posted in journals, which were (and for some small organizations, still are) actual books; nowadays, of course, the journals are typically part of the accounting software. Each transaction includes the date, the amount and a description.

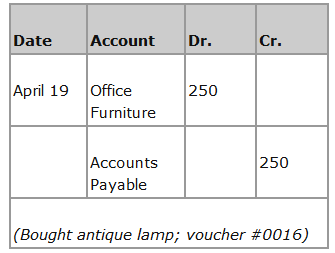

For example, suppose you have a stationery store. On April 19, a saleswoman for an antiques company visits you, and you buy a lamp for your office for $250. A journal entry to record the transaction as a debit to the Office Furniture account and a $250 credit toAccounts Payable could be written as follows (Dr. is the abbreviation for debit, while Cr. is for credit):

Each accounting transaction affects a minimum of two accounts, and there must be at least one debit and one credit.

Keeping Good Accounting Records

Even a seemingly simple transaction like this one raises a host of accounting issues.

Date:Suppose you had already agreed by phone to buy the lamp on April 15, but the paperwork wasn’t done until April 19. And the lamp wasn’t delivered on the 19th, but the 23rd. Or even as you bought it, you were thinking that you didn’t like it that much, and there’s a strong chance you’ll return it by the 30th, when the sale becomes final. On which date – 15th, 19th, 23rd, or 30th – did an economic event occur for which a transaction should be recorded?

Amount:The sales price is $250, but you get a 10% discount (to $225) if you pay in 30 days; business is bad, though, so you may need the full 90 days to pay. Similarly, however, you know the antique business is also lousy; even though you agreed to pay $250, you can probably chisel another $50 off the price if you threaten to return it. On the other hand, being in the stationery business, you know one of your customers has been looking for a lamp like that for a long time; he told you in February he’d pay $300 for one.

So what amounts should you record on April 19 (if indeed you record a transaction on that date)? $250 or $225 or $200 or $300?

Accounts:You’ve debited the Office Furniture account. But actually you buy and sell antiques frequently to your customers, and you’re always ready to sell the lamp if you get a good offer. Instead of an Office Furniture account used for fixed assets, should the lamp be recorded in a Purchases account you use for inventory? And if this was a big company, there might be dozens of office furniture sub-accounts to choose from.

Accountants rely on various resources to answer such questions. There are basic, time-honored accounting conventions: standards set forth by various rules-making bodies, long-standing industry practices and, most important, their own judgment honed through years of experience.

But the important point is that even the most basic accounting questions – when did an economic event take place? What is the value of the transaction? Which accounts are affected by the transaction? – can get very complex and the right answers prove very elusive. There’s no excuse for out-and-out misrepresentation of company results and sloppy auditing that certainly occurs. But the seeming precision of financial statements, no matter how conscientiously prepared, is belied by the uncertainty and ambiguity of the business activities they seek to represent.

Debits and Credits

We’re accustomed to thinking of a “credit” as something “good” – our account is credited when we get a refund; you get “extra credit” for being polite. Meanwhile, a “debit” is something negative – a debit reduces our bank balance; it’s used to mean shortcoming or disadvantage.

In accounting, debit means one thing: left-hand side. Credit means one thing: right-hand side. When you receive cash – a “good” thing – you increase the Cash account by debiting it. When you use cash – a “bad” thing – you decrease Cash by crediting it. On the other hand, when you make a sale, which is nice, you credit the Sales account; when someone returns what you sold, which is not nice, you debit sales.

“Good” and “bad” have nothing to do with debit and credit.

Debit = Left; Credit = Right. That’s it. Period.

Accrual vs. Cash Basis Accounting

As we’ve seen, deciding when an economic event occurs and an accounting transaction should be recorded is a matter of judgment. Accrual accounting looks to the economic reality of the business, rather than the actual inflows and outflows of cash.

Although cash basis statements are simpler and make good sense for many individual taxpayers and small businesses, it results in misleading financial statements. Consider a Halloween costume maker: it conceives, produces and sells costumes throughout the year, but gets paid for its costumes mostly in October. If sales were recognized only when cash was received, October would show an enormous profit while all other months would show losses. Accrual accounting seeks to match the revenues earned during a period with the expenses incurred to generate them, regardless of when cash comes in or goes out.